Things That Could Help You Win a Bidding War on a Home With a limited number of homes for sale today and so many buyers looking to make a purchase before mortgage rates rise further, bidding wars are common. According to the latest report from the National Association of Realtors (NAR), nationwide, homes are getting an average of 4.8 offers per...

Real Estate

With today’s real estate market moving as fast as it is, working with a real estate professional is more essential than ever. They have the skills, experience, and expertise it takes to navigate the highly detailed and involved process of selling a home. That may be why the percentage of people who list their houses on their own, known as an FSBO or For Sale By Owner, has reached its lowest...

Some Highlights If you have additional loved ones coming to live with you but don’t have enough space, it may be time to consider a larger, multigenerational home.Some key benefits of multigenerational living include a combined homebuying budget, shared caregiving duties, enhanced relationships, and more. These benefits might be why more people are choosing to live in...

In the last few weeks, the average 30-year fixed mortgage rate from Freddie Mac inched up to 5%. While that news may have you questioning the timing of your home search, the truth is, timing has never been more important. Even though you may be tempted to put your plans on hold in hopes that rates will fall, waiting will only cost you more. Mortgage rates are forecast to continue...

Being intentional and competitive are musts when buying a home this season. That’s why pre-approval is so important today. Pre-approval from a lender is the only way to know your true price range and how much money you can borrow for your loan. Peter Warden, Editor of The Mortgage Reports, explains: “The lender will check out your personal finances and issue you a letter...

Life events can have a major impact on what you need from your home, and retirement is one of the biggest changes many of us face. This period of your life can mean doing more of the things you enjoy, like traveling, visiting with loved ones, or taking on new hobbies. But what does that mean for your home? If you’re looking for ways to focus more on the important things in your life, the answer...

If you’re thinking of selling your house, it may be because you’ve heard prices are rising, listings are going fast, and sellers are getting multiple offers on their homes. But why are conditions so good for sellers today? And what can you expect when you move? To help answer both of those questions, let’s turn to the data. Today, there are far more buyers...

There’s never been a truer statement regarding forecasting mortgage rates than the one offered last year by Mark Fleming, Chief Economist at First American: “You know, the fallacy of economic forecasting is: Don't ever try and forecast interest rates and or, more specifically, if you're a real estate economist mortgage rates, because you will always invariably be...

If you’re buying or selling a home this year, you’re likely saving up for a variety of expenses. For buyers, that might include things like your down payment and closing costs. And for sellers, you’re probably working on a bit of spring cleaning and maintenance to spruce up your house before you list it. Either way, any money you get back from your taxes can help you achieve...

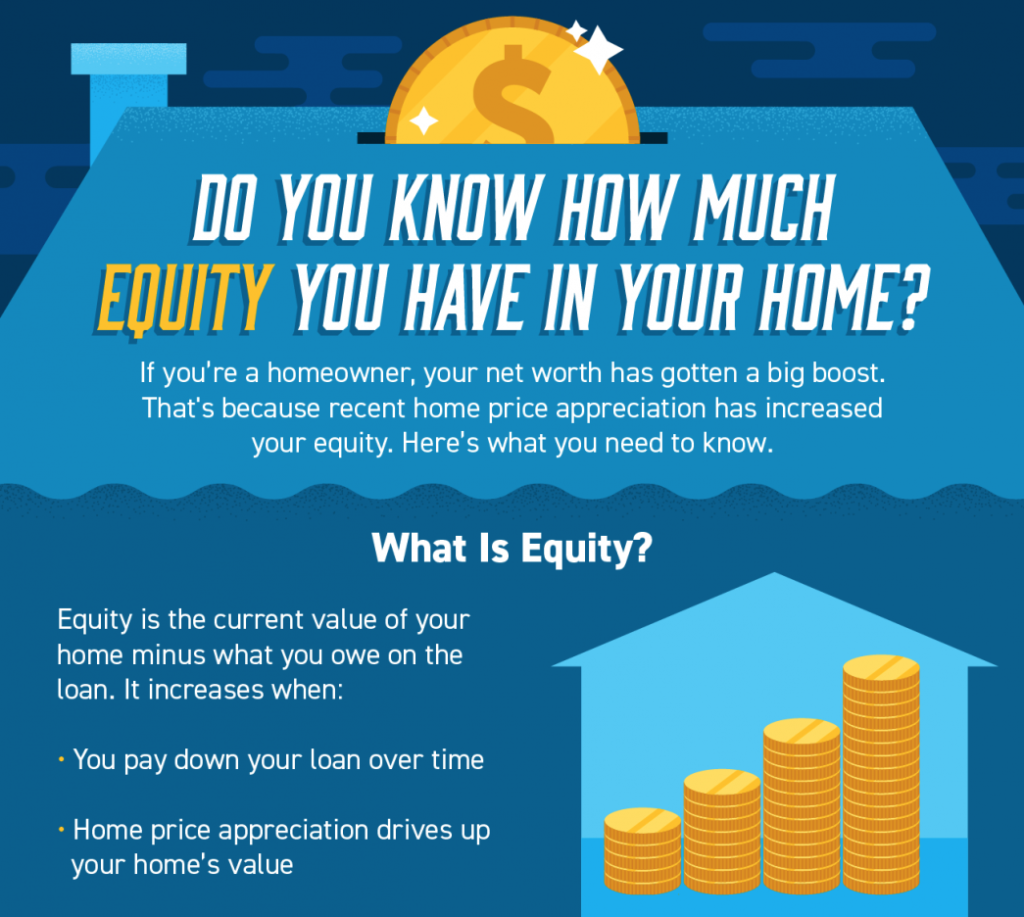

Some Highlights If you’re a homeowner, your net worth has gotten a big boost. That’s because recent home price appreciation has increased your equity.Your equity grows as you pay down your loan and as your home increases in value. Over the past year, the average homeowner’s equity grew by $55,300.Ready to sell? Let’s connect to talk about how you...